Solana On Brink Of Registering Fresh All-Time

In a year marked by impressive gains, Solana, the high-performance blockchain platform, has consistently surpassed expectations. Since late 2022, Solana’s network growth has been underpinned by record-breaking metrics in revenue, total value locked (TVL), and decentralized exchange (DEX) trading volume. These factors are sparking discussions across the crypto community about Solana's growth potential and whether the platform's native token, SOL, will see a similar surge.Solana price trending upward on the daily chart | Source: SOLUSDT on Binance, TradingView

Currently, SOL has doubled its value over the past ten months, making Solana the third-largest smart contract platform after Ethereum and BNB Chain. However, with rising on-chain engagement and an influx of meme coin activity, many analysts argue that the token remains undervalued relative to its recent performance metrics.

Record Growth in Revenue and TVL

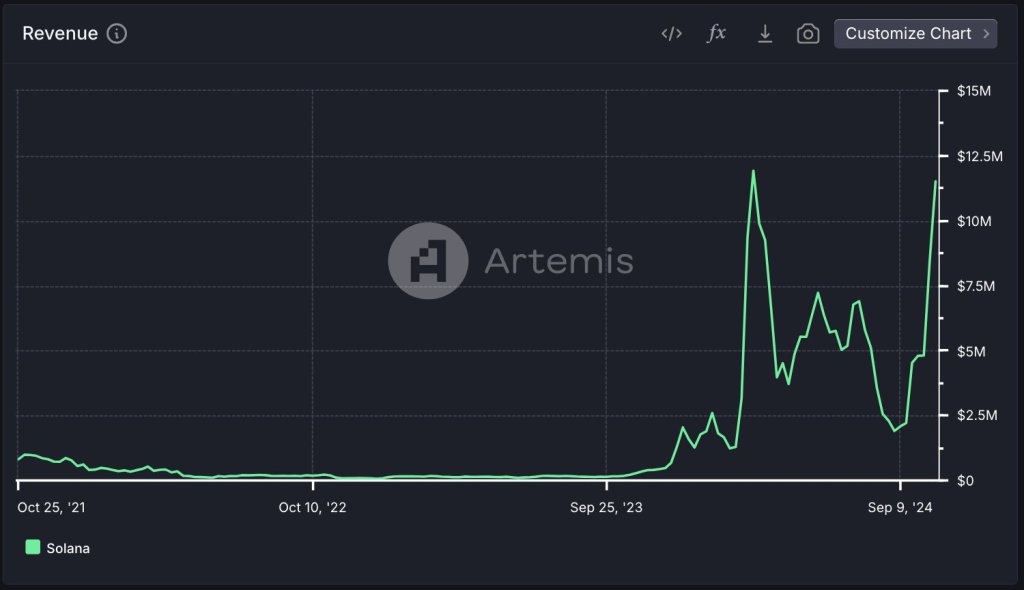

One of the primary drivers of Solana's recent momentum has been its substantial revenue growth. As a blockchain platform, Solana generates revenue from gas fees payments made by users to process transactions or deploy smart contracts. With an increase in transaction volume, Solana’s revenue has steadily increased, now approaching $12.5 million as per recent data from Artemis. This level represents a significant recovery since the downturn in late 2022, indicating sustained demand for Solana’s blockchain services.

Solana’s revenue growth highlights the platform’s expanding utility and user base, supported by its unique consensus mechanism. Unlike most blockchains that rely solely on Proof of Stake (PoS), Solana uses a hybrid consensus mechanism called Proof of History (PoH) combined with PoS. This architecture has enabled Solana to consistently process transactions at a higher speed and lower cost, attracting a diverse range of users and developers. From decentralized finance (DeFi) applications to NFT marketplaces, Solana’s ecosystem continues to expand rapidly.

In addition to revenue, Solana’s TVL representing the total value of assets locked within its smart contracts—has also seen substantial growth. As of October 2023, Solana’s TVL exceeded $6 billion, marking a strong recovery from the lows seen in late 2022. While this figure is still below the platform's all-time high of $10 billion recorded in October 2021, it demonstrates a resilient uptrend. Analysts see this metric as an important indicator of user confidence, suggesting that more investors are choosing to lock their assets within Solana-based protocols, likely due to competitive yields and growing ecosystem activity.

According to data from DeFiLlama, Solana’s leading DeFi protocols, such as the liquid staking platform Jito, now manage over $2.4 billion in assets. Additionally, Raydium, one of Solana’s most popular decentralized exchanges, handles more than $1.4 billion in assets, marking a 28% increase in just one month. This growth in TVL underscores the platform’s increasing appeal to DeFi users and hints at the potential for future growth in SOL’s price, should these metrics continue on an upward trajectory.

Rising Meme Coin Activity and DEX Volume

Another key factor driving Solana’s recent growth is the surge in meme coin activity across the network. Since the launch of Pump.fun, a platform focused on meme coins, in January 2024, Solana has seen a noticeable uptick in on-chain engagement and trading volume. Meme coins, known for their high trading volumes and speculative nature, have brought an influx of new users to the Solana network, contributing to the record levels of DEX trading volume observed this year.

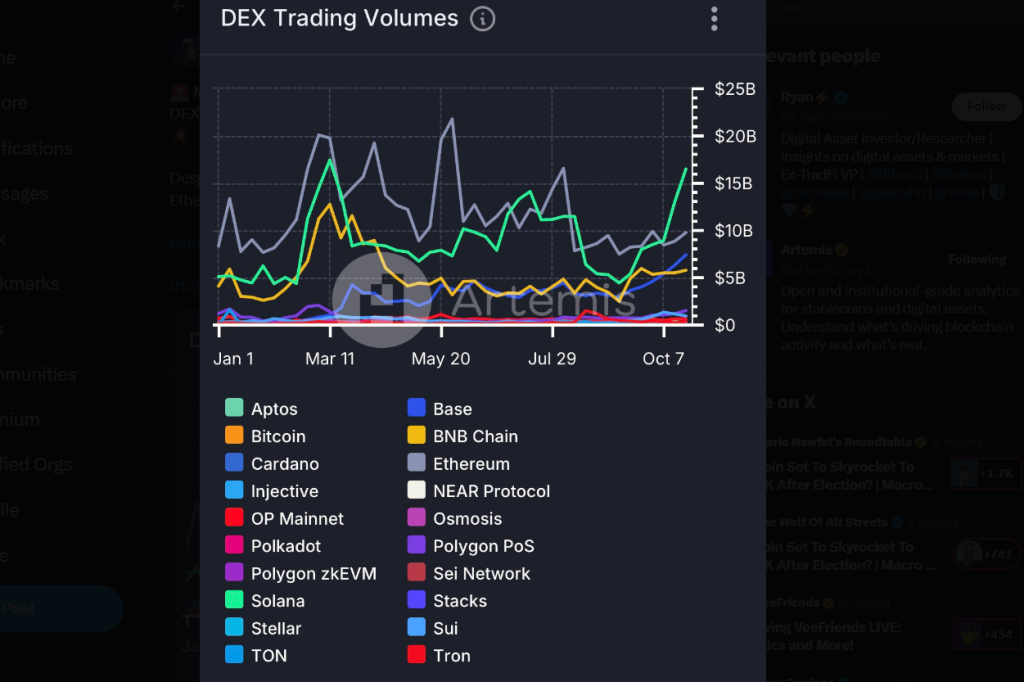

On October 27, an analyst reported that Solana had overtaken leading blockchains such as Aptos, Injective, and Cardano in weekly DEX trading volume, reaching over $15 billion. This figure represents a 150% increase compared to Ethereum’s DEX volume over the same period, a notable achievement for Solana given Ethereum’s longstanding dominance in the DeFi sector.

The rise in DEX activity can be attributed to Solana’s low transaction fees and high throughput, which make it an attractive platform for trading and swapping tokens. Unlike Ethereum, where high gas fees can limit trading activity during periods of network congestion, Solana’s efficiency has allowed it to support high trading volumes at lower costs. This cost-effectiveness has positioned Solana as a leading blockchain for meme coin activity, with significant interest from retail traders seeking quick transactions and low fees.

Moreover, the increased DEX volume on Solana suggests that more users are interacting with the platform’s DeFi applications, further bolstering Solana’s revenue from gas fees. This positive feedback loop—where more users drive up revenue, which in turn funds further development—could set the stage for SOL to reach new price highs in the coming months.

Will SOL Price Follow Solana's Metrics?

Despite the impressive growth in Solana’s core metrics, SOL’s price has yet to break through key resistance levels. As of October 2023, SOL is trading around $180, a significant improvement from last year’s lows but still below its 2021 peak of $260. Analysts are divided on whether SOL will follow the trajectory of Solana’s on-chain metrics, but many see the platform’s growing activity as a promising sign. Solana DEX volume up | Source: @Cryptosisfinanc via X

Solana DEX volume up | Source: @Cryptosisfinanc via X

“Solana’s revenue and TVL indicate strong demand for its services,” noted one analyst on X (formerly Twitter). “Given the platform’s unique architecture and competitive edge in transaction speed, it’s likely that SOL could be undervalued relative to the underlying metrics.”

If SOL is indeed undervalued, the token could potentially breach the $200 mark, a psychological level that could attract more retail investors and drive further gains. However, market conditions remain uncertain, and SOL’s performance will largely depend on the continued growth of Solana’s ecosystem and the broader crypto market trends. Solana revenue | Source: @0xMert_ via X

Solana revenue | Source: @0xMert_ via X

For SOL to achieve new all-time highs, analysts believe that Solana will need to maintain its growth in TVL and revenue, particularly through continued engagement with DeFi and NFT applications. Additionally, the rise of Solana-based projects focused on meme coins and gaming could further diversify its user base and create new use cases for SOL, adding to its intrinsic value.

Conclusion

Solana’s strong performance in 2023 has demonstrated the platform’s resilience and potential to disrupt the blockchain landscape. As revenue, TVL, and on-chain activity continue to rise, the network is proving its appeal to both developers and users seeking an efficient, cost-effective alternative to other platforms. While SOL’s price has yet to reach its previous highs, the steady growth in Solana’s key metrics provides a strong foundation for future gains.

Looking ahead, Solana’s success will likely depend on its ability to attract new projects, particularly in DeFi and NFT spaces, where the platform has shown considerable promise. With its recent metrics positioning it as a serious contender in the blockchain space, Solana’s performance could make it a strong competitor to Ethereum and BNB Chain in the coming years. If the platform continues its upward trajectory, SOL could indeed follow, potentially reaching new milestones that reflect the platform’s growing value and utility in the blockchain ecosystem.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Did Swapping My BTC Make Sense???](https://cdn.bulbapp.io/frontend/images/7e72b545-835a-4cd4-927d-48fed129d7b7/1)