Proof of Work vs. Proof of Stake: Mining and Consensus Mechanisms Explained

In the ever-evolving world of blockchain technology, two key concepts underpin the security and integrity of these digital ledgers: Proof of Work (PoW) and Proof of Stake (PoS). These mechanisms act as the lifeblood of blockchains, ensuring trust and consensus among participants without the need for a central authority. But what exactly are they, and how do they differ? Buckle up, because we're diving deep into the fascinating world of mining and consensus mechanisms!

Proof of Work: The OG of Blockchain Security

Imagine a network of miners, armed with powerful computers, competing to solve complex mathematical puzzles. This is the essence of Proof of Work. The first miner to crack the code gets to validate a block of transactions, adding it to the blockchain and earning rewards in the process. This competition creates a secure system, as tampering with the blockchain would require immense computational power, making it practically infeasible.

Pros of PoW:

Highly secure: The competitive nature of PoW makes it resistant to attacks, as malicious actors would need to control a majority of the network's computing power.

Decentralized: Anyone with the necessary equipment can participate in mining, fostering a distributed and democratic network.

Well-established: PoW has been around since the inception of Bitcoin, making it a proven and trusted technology.

Cons of PoW:

Energy-intensive: The constant competition for mining rewards requires significant amounts of electricity, raising environmental concerns.

Slow and expensive transactions: Validating transactions can be slow and costly due to the computational power required.

Scalability challenges: As the network grows, processing transactions becomes more complex, potentially hindering scalability.

Proof of Stake: A Greener, Faster Alternative

Instead of brute computational force, Proof of Stake relies on "skin in the game." Participants, called validators, lock up a certain amount of cryptocurrency as collateral, essentially staking their claim in the network. The system randomly selects validators based on their stake size, giving them the opportunity to propose and validate new blocks. If they act maliciously, they risk losing their staked coins, incentivizing honest behavior.

Pros of PoS:

Energy-efficient: No more computational arms races! PoS eliminates the need for powerful mining rigs, significantly reducing energy consumption.

Faster and cheaper transactions: Validation is less resource-intensive, leading to faster and cheaper transactions.

Scalable: PoS networks can handle higher transaction volumes without compromising speed or security.

Cons of PoS:

Security concerns: While generally secure, PoS networks might be susceptible to attacks if a large number of coins are concentrated in few hands.

Less decentralized: The initial coin distribution can influence validator selection, potentially impacting decentralization.

Relatively new: PoS is still evolving, and its long-term security implications are yet to be fully tested.

The Great Mining Debate: Which is Better?

There's no simple answer. Both PoW and PoS offer unique advantages and disadvantages. The choice for a specific blockchain depends on its specific needs and goals. Bitcoin, prioritizing security and decentralization, sticks with PoW, while Ethereum, aiming for scalability and efficiency, has transitioned to PoS.

The Future of Consensus Mechanisms

The world of blockchain technology is constantly innovating. Hybrid models combining elements of PoW and PoS are emerging, and new consensus mechanisms are being explored. As the technology matures, we can expect further advancements, leading to more efficient, secure, and scalable blockchains.

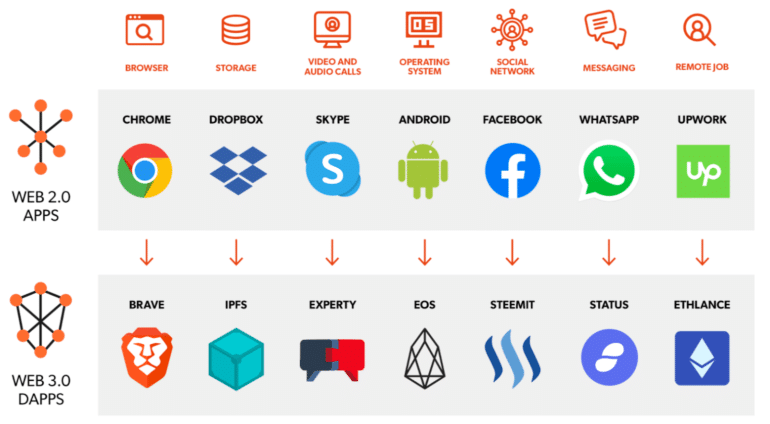

Decentralized Applications (dApps): Building on the Blockchain

The digital landscape is constantly evolving, and the emergence of blockchain technology has introduced a paradigm shift: decentralized applications (dApps). Unlike traditional applications which rely on centralized servers, dApps leverage the power of blockchain to create secure, transparent, and user-controlled experiences.

This article delves into the world of dApps, exploring their fundamentals, building blocks, and potential to revolutionize various industries.

Demystifying dApps: What are they?

Imagine an application that operates without a central authority, its data and functionalities distributed across a global network of computers. This is the essence of a dApp. Built on top of blockchains like Ethereum, dApps utilize smart contracts, self-executing code that governs interactions and transactions on the network. This eliminates the need for intermediaries, fostering trust and reducing potential manipulation.

Key characteristics of dApps:

- Decentralization: No single entity controls the application, promoting resilience and censorship resistance.

- Transparency: All transactions and data are publicly viewable on the blockchain, ensuring accountability and openness.

- Security: Cryptographic protocols and distributed ledger technology safeguard the dApp from malicious attacks.

- Immutability: Once recorded on the blockchain, data cannot be altered, guaranteeing data integrity and auditability.

Building Blocks of dApps: From concept to reality

Growth and intensity

Developing a dApp involves several crucial components:

- Smart contracts: The backbone of dApps, defining rules and automating processes transparently and securely.

- Front-end: The user interface, accessible through web browsers or mobile apps, allowing users to interact with the dApp.

- Backend: APIs and infrastructure connecting the front-end to the blockchain network, facilitating data exchange and smart contract execution.

- Consensus mechanism: The process by which the network validates transactions and maintains distributed ledger consistency (e.g., Proof of Work, Proof of Stake).

- Cryptocurrency: Often used within dApps to incentivize network participation and facilitate value exchange.

Unlocking Potential: dApps across industries

The versatility of dApps opens doors to diverse applications across various sectors:

- Finance (DeFi): Peer-to-peer lending, borrowing, and trading without relying on traditional institutions.

- Gaming: Decentralized ownership of in-game assets, transparent gameplay mechanics, and new monetization models.

- Social media: Censorship-resistant platforms empowering users with control over their data and online interactions.

- Supply chain management: Tracking goods and materials transparently from source to consumer, improving efficiency and trust.

- Voting systems: Secure and verifiable voting processes, minimizing fraud and manipulation.

Challenges and Considerations: The Road Ahead

While dApps hold immense potential, there are challenges to overcome:

- Scalability: Current blockchain networks face limitations in transaction processing speed, hindering mainstream adoption.

- User experience: Complex interfaces and technical barriers can create an entry barrier for non-technical users.

- Regulations: The evolving nature of dApps necessitates clear regulatory frameworks to protect users and foster innovation.

Despite these challenges, the dApp ecosystem is rapidly maturing, attracting developers and investors. As technology advances and regulatory frameworks evolve, dApps are poised to transform industries, empower users, and redefine the landscape of the digital world.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - WEN ALT Season?](https://cdn.bulbapp.io/frontend/images/5e881bda-7f7a-42c8-9a03-01263004c332/1)