The SEC, Cryptocurrency Cop or Regulator...

The next phase of cryptocurrency oversight is uncertain. While forthcoming Congressional legislation would make the Commodity Futures Trading Commission, or CFC, the primary regulator, the Securities and Exchange Commission is stretching its muscles.

SEC Chair Gary Gensler has said unequivocally that the agency aims to be the primary regulator of the US crypto industry.

On September 8, Gensler stated that the SEC will be actively monitoring crypto coins and intermediaries. On September 19, the government quietly—but radically—suggested in a lawsuit that it would seize authority over the whole Ethereum network.

Ether, which is the second-largest cryptocurrency by market value, was formerly regarded as a commodity and hence beyond the purview of the SEC. These two events may possibly determine the rules that crypto firms and consumers will confront in the next months and years.

Industry stakeholders and intermediaries will need to adjust to the SEC's increased enforcement techniques and assertion of market authority.

The Securities and Exchange Commission (SEC) refused the first spot bitcoin exchange-traded fund (ETF) application about seven years ago, citing the danger of market manipulation to investors. It would become a common theme for the innumerable rejections that would follow.

The regulator will have to explain himself.

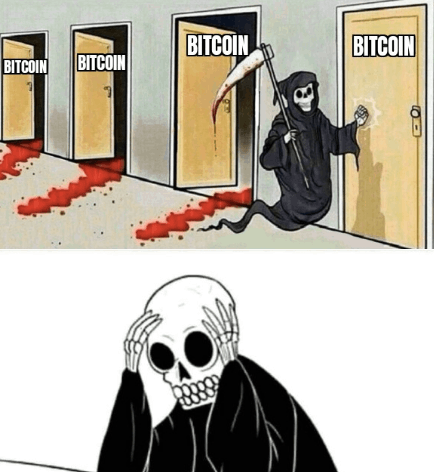

The false tweet from the SEC's official X (previously Twitter) account on Tuesday caused bitcoin's price to spike and then crash as traders struggled to make sense of the apparent approval. The powerful regulator appears to have just approved every prospective BTC ETF application, handing bitcoin speculators their long-awaited win a full day ahead of schedule.

The strange post, which was accompanied by a $BTC cashtag, was, of course, a scam. Chair Gary Gensler quickly tweeted from his own account that the SEC had not authorized anything. In reaction, bitcoin markets continued to fall.

The entire charade spurred calls for a probe into how the SEC allowed itself to become a misinformation platform from crypto-friendly legislators and outraged social media users alike.

"Fraudulent announcements, such as the one made on the SEC's social media, have the potential to manipulate markets." "We need transparency on what happened," Senator Cynthia Lummis (R-Wyo.) tweeted after the SEC admitted its account was "compromised."

It was an odd twist in what many thought would be the closing hours of the SEC's obstruction of the spot bitcoin ETF.

The SEC's own pronouncements set the stage for traders to overreact to this sort of disinformation. The regulator tweeted in mid-October,

"Be careful what you read on the internet." "The best source of information about the SEC is the SEC,"

he said in response to a CoinTelegraph tweet that was later withdrawn, claiming that BlackRock's bitcoin ETF application had been accepted.

While the first half of the tweet held up on Tuesday, the second half was reduced to comedy. Many pundits have stated that the SEC cannot be trusted for what is going on at the SEC.

An SEC representative told CoinDesk last week that any rulings will first be disclosed on the SEC's internal EDGAR database. Of course, on Tuesday, the ordinary people and even knowledgeable observers ignored such advice. In reaction to Gensler, Rep. Bill Huizenga tweeted,

"Does this mean we can blame more of the @secgov's horrible rulemaking and so-called regulation by enforcement on a 'compromised account'?"

Aside from the hilarious irony, the SEC's presumably hacked account prompted unpleasant questions about how seriously the agency handled its obligation to secure itself in order to protect investors (though it's unclear how the X account was hijacked).

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)