Crypto Market Booms: 110% Surge in Market Cap Spotlights the Rise of Stablecoins, NFTs and RWA Token

Crypto’s Phenomenal 110% YTD Surge

Crypto’s Phenomenal 110% YTD Surge

In the thrilling arena of cryptocurrencies, a seismic shift has occurred. Picture this: a staggering 110% surge in the crypto market capitalization, a testament to the dynamic nature of digital assets. Investors and enthusiasts alike are riding the waves of this unprecedented growth, eagerly seeking to understand the forces steering the crypto ship. So, what’s behind this monumental surge, and why is the world of stablecoins, NFTs, and RWA tokenization stealing the spotlight?

Riding the Wave: The Crypto Market’s Incredible Journey

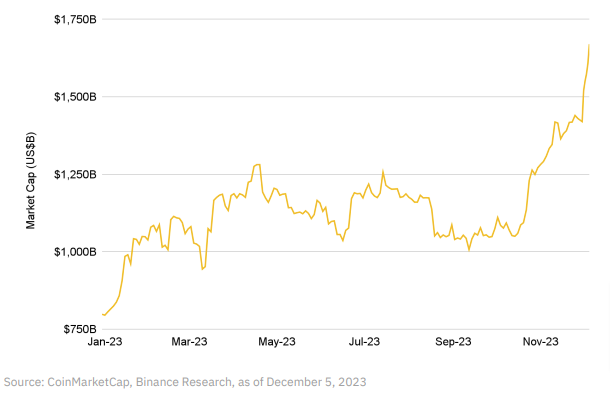

Milestone Moments: Tracking the 110% Year-to-Date Growth Let’s start by zooming in on the milestones that have marked this exceptional journey. Numbers don’t lie, and the statistics reveal a jaw-dropping 110% year-to-date growth, a meteoric rise that has added over $870 billion to the crypto market. The excitement doesn’t stop there; Q4 alone witnessed a remarkable 55% surge. But what sparked this crypto renaissance after the post-2021 highs? The answer lies in the interplay of various factors driving the market dynamics.

Let’s start by zooming in on the milestones that have marked this exceptional journey. Numbers don’t lie, and the statistics reveal a jaw-dropping 110% year-to-date growth, a meteoric rise that has added over $870 billion to the crypto market. The excitement doesn’t stop there; Q4 alone witnessed a remarkable 55% surge. But what sparked this crypto renaissance after the post-2021 highs? The answer lies in the interplay of various factors driving the market dynamics.

This staggering surge in market cap is not just a numerical feat; it signifies an unprecedented demand for crypto token development. As the numbers paint a compelling picture of growth, the clamor for innovative tokens and blockchain solutions intensifies, shaping a landscape where the demand for crypto assets is as formidable as the surge that propels it.

Market Dynamics: Shifting Trends Post-2021 Crypto Highs

Post-2021, the crypto landscape experienced a period of relative stagnation. Imagine the crypto market as a chessboard; after a series of strategic moves, it hit a plateau. However, with the onset of the surge, the pieces started moving again, marking a shift in the market dynamics. Investors and analysts are eager to decode this shift, understanding how the pieces are aligning to create new patterns and opportunities. It’s a chess game where every move counts, and the stakes are higher than ever.

The Power Trio: Stablecoins, NFTs, and RWA Tokenization

Cryptocurrency enthusiasts, fasten your seatbelts; we’re diving into the heart of the crypto surge, exploring the extraordinary roles played by stablecoins, NFTs, and RWA tokenization. Imagine this: the crypto stage is set, and these three protagonists are stealing the spotlight, each with its unique storyline.

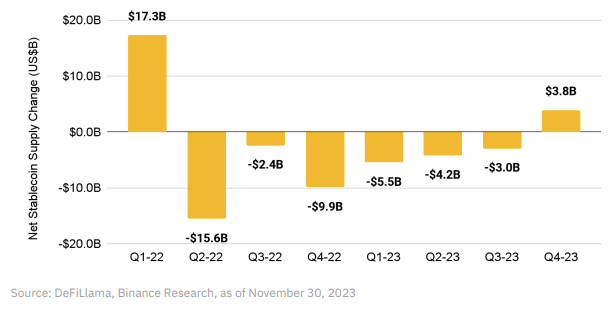

Stablecoins Steal the Show

Stablecoins, often seen as the unsung heroes of the crypto world, have orchestrated a plot twist that caught everyone off guard. It’s not just a surge; it’s a game-changer. The quarterly net change in the supply of the top five stablecoins experienced a positive shift, a phenomenon unseen since the early days of 2022. This shift isn’t just about numbers; it’s about a growing interest, a collective nod from investors entering the crypto arena. It’s akin to a fresh breeze sweeping through, signaling the arrival of something new, something different. And here’s the plot thickening moment — a surge of capital into cryptocurrencies. It’s not just an influx; it’s a statement. Stablecoins are no longer lurking in the shadows; they’ve stepped into the limelight, declaring their role in the crypto narrative. Investors, ever watchful, are drawn to this development, like moths to a flame. It’s a revelation, a turning point that adds layers to the intricate tale of the crypto market.

And here’s the plot thickening moment — a surge of capital into cryptocurrencies. It’s not just an influx; it’s a statement. Stablecoins are no longer lurking in the shadows; they’ve stepped into the limelight, declaring their role in the crypto narrative. Investors, ever watchful, are drawn to this development, like moths to a flame. It’s a revelation, a turning point that adds layers to the intricate tale of the crypto market.

In the unfolding narrative of stablecoins stealing the show, there emerges an undeniable hunger for stablecoin development. As these steadfast digital assets take center stage, the demand for creating and innovating stablecoins surges, marking a pivotal moment where the crypto community recognizes the crucial role stablecoins play in reshaping the financial landscape.

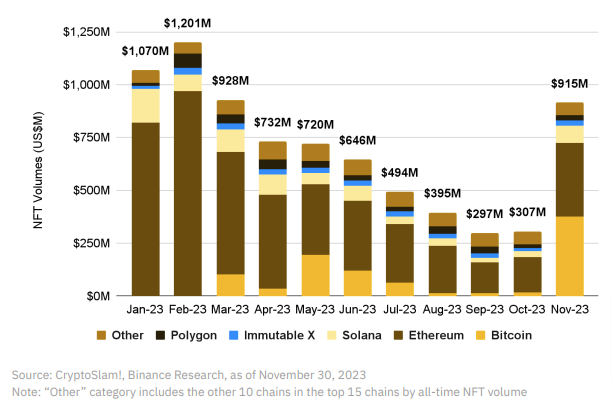

NFT Resurgence: Beyond Expectations

Now, let’s shift our focus to the resurgence of NFTs, particularly the dance of Bitcoin NFTs. If the crypto market were a stage, this would be the part where the spotlight returns, casting its glow on a segment that witnessed a year-long downtrend. The script takes an unexpected twist; Bitcoin NFT trade volumes are not just bouncing back; they’re soaring to new heights, breaking free from the chains of a prolonged slump. The resurgence of NFT trade volumes is not just a statistical blip; it’s a revival in the truest sense. It’s the market saying, “We’re not done yet.” It’s speculation finding its rhythm again, a renewed sentiment echoing through the digital corridors of the crypto world. Investors, skeptics turned curious, are now pondering the possibilities. It’s a comeback story that defies expectations, proving that in the crypto narrative, every downtrend has the potential to be an intermission, not a conclusion.

The resurgence of NFT trade volumes is not just a statistical blip; it’s a revival in the truest sense. It’s the market saying, “We’re not done yet.” It’s speculation finding its rhythm again, a renewed sentiment echoing through the digital corridors of the crypto world. Investors, skeptics turned curious, are now pondering the possibilities. It’s a comeback story that defies expectations, proving that in the crypto narrative, every downtrend has the potential to be an intermission, not a conclusion.

This resurgence of NFT trade volumes isn’t just a comeback; it’s a rallying cry for increased demand in NFT development. As the market proves its resilience, the call for creating and innovating in the NFT space grows louder, capturing the attention of creators, collectors, and investors alike who recognize the enduring potential of this digital revolution.

RWA Tokenization Gains Momentum

In the midst of the crypto spectacle, RWA tokenization emerges as a subplot with MakerDAO at the helm. The stage is set for a grand transformation as real-world assets step into the crypto limelight. MakerDAO isn’t just a player; it’s a leader, spearheading the tokenization of real-world assets. Think of it as traditional finance donning a crypto cloak, a bridge between two realms that were once considered distant cousins.

Enter Chainlink’s Cross-Chain Interoperability Protocol, the unsung hero in this tale of integration. It’s not just about linking chains; it’s about connecting financial worlds. The protocol is a technological maestro orchestrating a symphony that resonates through the crypto landscape. RWA tokenization isn’t merely a concept; it’s a movement, a shift that prompts both curiosity and excitement among investors. It’s the crypto world saying, “Watch us redefine the rules.”

As MakerDAO and Chainlink lead the charge, the demand for RWA tokenization development surges, painting a future where real-world assets seamlessly integrate into the crypto narrative, sparking intrigue and anticipation among investors looking to be part of this transformative movement.

Maturation in Action: Crypto Platforms Becoming Revenue Giants

The crypto landscape is undergoing a transformation, evolving from its nascent stages into a maturing powerhouse. It’s not just about transactions and tokens; it’s about platforms becoming revenue giants. Imagine the crypto market as a bustling city, and within it, the skyscrapers represent these platforms, reaching new heights in generating revenue.

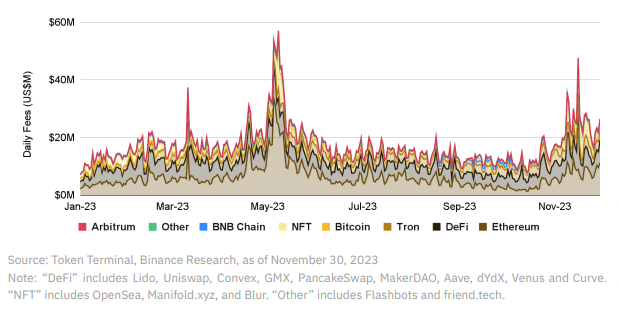

Fee Surge: A Sign of Maturation In the month of November, the crypto world experienced a crescendo of financial activity, and at the heart of it was a surge in fees generated by leading crypto projects. It’s not just a numerical spike; it’s a symphony of financial maturation. The fees are akin to the toll collected on a busy bridge, indicating a bustling economy and a maturing infrastructure.

In the month of November, the crypto world experienced a crescendo of financial activity, and at the heart of it was a surge in fees generated by leading crypto projects. It’s not just a numerical spike; it’s a symphony of financial maturation. The fees are akin to the toll collected on a busy bridge, indicating a bustling economy and a maturing infrastructure.

Zooming into the crowd, Ethereum emerges as a standout figure, proudly wearing the crown in fee generation. The Ethereum network, much like a well-established toll booth on the highway, is efficiently processing transactions, collecting fees, and solidifying its position as a leader in the crypto realm. This fee surge isn’t just revenue; it’s a sign that crypto platforms are not just players in the market — they are evolving into financial powerhouses.

Bitcoin’s Dominance and Emerging Trends

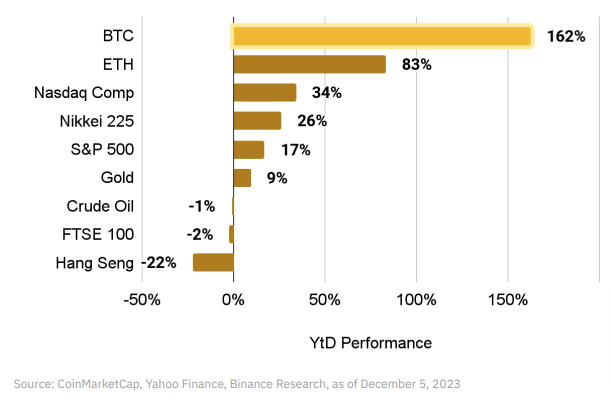

Now, let’s shift our focus to the heavyweight champion of the crypto world: Bitcoin. In 2023, Bitcoin flexed its muscles, boasting a remarkable 162% increase in market cap. Think of Bitcoin as the elder statesman in the crypto city, with years of experience and a formidable presence.

Bitcoin’s Remarkable 162% Surge in 2023 The surge in Bitcoin’s market cap is not just a numerical feat; it’s a testament to the resilience of the digital gold. It’s as if Bitcoin, the seasoned maestro, orchestrated a symphony of growth, with each note representing factors like the anticipated U.S. spot Bitcoin ETF and the upcoming Bitcoin halving.

The surge in Bitcoin’s market cap is not just a numerical feat; it’s a testament to the resilience of the digital gold. It’s as if Bitcoin, the seasoned maestro, orchestrated a symphony of growth, with each note representing factors like the anticipated U.S. spot Bitcoin ETF and the upcoming Bitcoin halving.

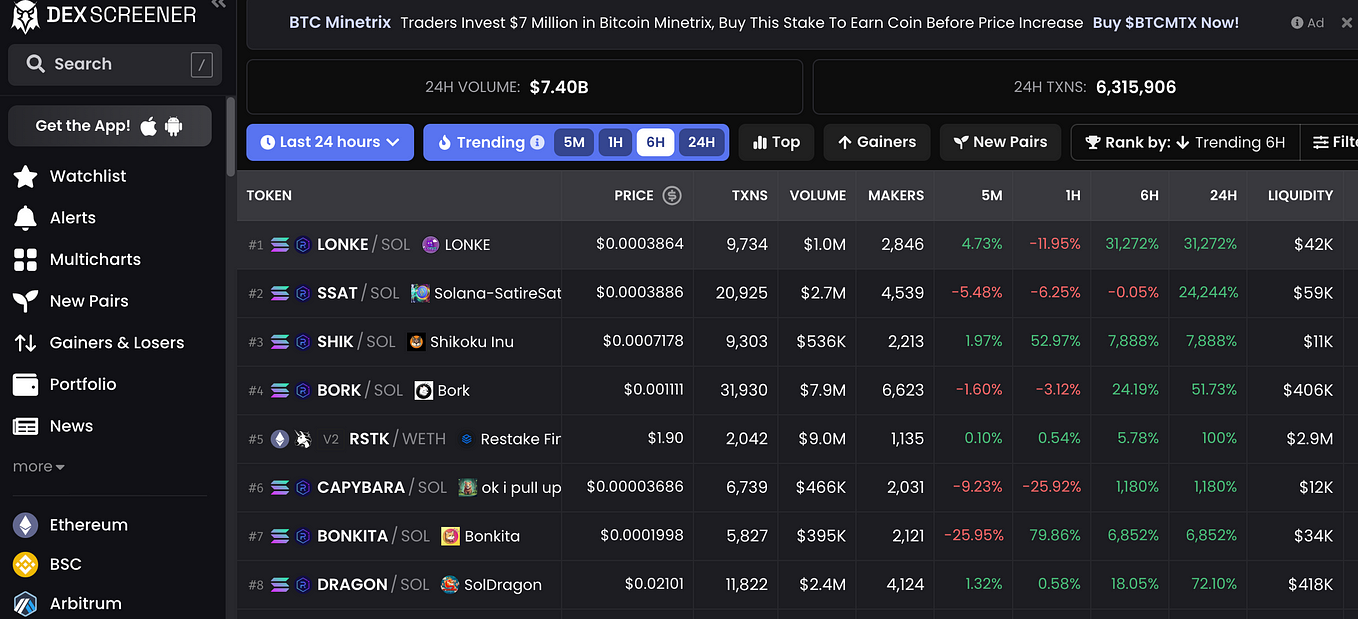

As we delve deeper, we encounter a diverse landscape within the blockchain ecosystem. Imagine this ecosystem as a vibrant garden, with various flowers representing alternative Layer-1 platforms. Solana and Toncoin, in particular, stand tall and bloom brightly. Their noteworthy performances showcase the growing diversity within the blockchain garden, challenging the dominance of the established players.

Driving Forces: U.S. Spot Bitcoin ETF and Upcoming Bitcoin Halving

Peering into Bitcoin’s surge, we discover the driving forces behind this remarkable growth. The anticipation surrounding the U.S. spot Bitcoin ETF is a beacon, guiding institutional and retail investors alike toward the digital gold. Picture this: investors eagerly awaiting the gates to open, allowing them access to Bitcoin through traditional financial channels. The ETF becomes the bridge between the conventional investment world and the crypto frontier, creating a ripple effect of interest and capital inflow.

Additionally, the impending Bitcoin halving adds an intriguing layer to this narrative. Imagine a clock ticking down, each second bringing us closer to a momentous event. The halving is not just a routine occurrence; it’s a fundamental aspect of Bitcoin’s design. As the reward for miners decreases, scarcity amplifies, transforming Bitcoin into a digital rarity. This scarcity narrative, much like a rare gem in a collection, enhances its allure and, subsequently, its market value.

Diversity Unleashed: Solana and Toncoin Showcasing Blockchain Ecosystem Growth

Venturing further into the blockchain ecosystem, we encounter the dynamic duo: Solana and Toncoin. In the bustling garden of alternative Layer-1 platforms, these players stand out like vibrant blooms. Solana, with its high-speed transactions, is the agile sprinter, swiftly making its way to the forefront. Toncoin, on the other hand, is the silent heavyweight, making waves with its promising performance.

These emerging platforms are not mere spectators; they are active participants in the evolution of the blockchain landscape. Their growth signifies a shift toward diversity, challenging the long-standing dominance of established players. It’s akin to a garden where new flowers not only add color but also reshape the entire aesthetic, ushering in a new era of possibilities.

Beyond the Basics: Rise of SocialFi, ZK Tech, and More

Welcome to the frontier of crypto evolution, where innovation knows no bounds. In this chapter of our exploration, we’ll uncover the rising stars that are pushing the boundaries beyond the basics, introducing SocialFi, ZK Tech, and more into the limelight.

SocialFi Takes Center Stage

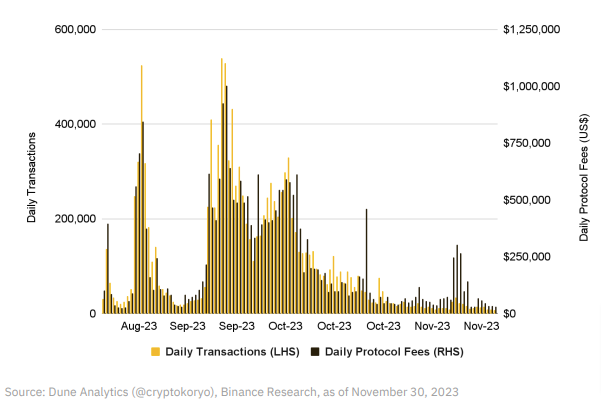

In the grand theater of crypto, a new act is stealing the spotlight — SocialFi. Imagine the fusion of social media and blockchain, and you’ll find Friend.tech at the forefront of this revolutionary integration. It’s not merely a technological advancement; it’s a paradigm shift. Friend.tech is not just leading; it’s pioneering the connection between social interactions and decentralized networks. Here’s the friend.tech daily transactions(LHS) and daily protocol fees(RHS), As SocialFi development emerges, it’s not just about technology; it’s a cultural phenomenon. Like a magnetic force, it’s attracting attention not just from tech enthusiasts but also from investors keen on riding the wave of the next big thing. The fees generated by SocialFi projects are not just digits; they represent a tangible impact, a financial echo of a concept that’s reshaping the way we envision the intersection of social platforms and decentralized ecosystems.

As SocialFi development emerges, it’s not just about technology; it’s a cultural phenomenon. Like a magnetic force, it’s attracting attention not just from tech enthusiasts but also from investors keen on riding the wave of the next big thing. The fees generated by SocialFi projects are not just digits; they represent a tangible impact, a financial echo of a concept that’s reshaping the way we envision the intersection of social platforms and decentralized ecosystems.

Zero-Knowledge Tech Gains Momentum

Now, let’s dive into the intricate world of Zero-Knowledge (ZK) technology. It’s not just a buzzword; it’s a technological marvel that’s gaining momentum. ZK-Rollups, the cutting-edge launches that leverage Zero-Knowledge proofs, are shaping the future of blockchain scalability. Think of it as a leap forward, a giant stride in the quest for faster and more efficient blockchain networks.

The rise of ZK rollups development is not just a niche development; it’s a testament to the depth of discussions within the crypto community. It’s as if the industry is collectively pondering the possibilities of enhanced privacy and security. In-depth discussions are not just intellectual exercises; they’re the building blocks of a future where Zero-Knowledge technology plays a pivotal role in shaping the landscape of decentralized systems.

Macroeconomic Factors and Future Possibilities

As we navigate the tumultuous waters of the crypto market, it’s crucial to set our sights on the horizon influenced by macroeconomic factors. The global stage is witnessing a significant player — lowering interest rates. It’s not just an economic maneuver; it’s a force reshaping investment landscapes worldwide. The question that naturally arises is, how does this impact the crypto realm?

Global Impact: Lowering Interest Rates Redirecting Investments

In the vast sea of financial possibilities, the lowering of global interest rates acts as a powerful tide, redirecting investments towards high-growth sectors. It’s not merely a fluctuation in the economic current; it’s a deliberate move that echoes through various industries. Cryptocurrency emerges as a standout contender, a high-growth sector poised to absorb the redirected financial currents.

Why cryptocurrency, you may wonder? The answer lies in the inherent nature of digital assets. When traditional investment avenues offer diminishing returns due to lowered interest rates, the allure of high-potential sectors becomes irresistible. Cryptocurrency, with its dynamic nature and potential for substantial returns, beckons investors seeking avenues where their capital can not only thrive but flourish.

High-Growth Sectors: Cryptocurrency’s Potential Amidst Lower Global Interest Rates

Let’s delve into the realm of high-growth sectors, where cryptocurrency takes the spotlight. It’s not just about decentralized tokens and blockchain; it’s a broader canvas painted with innovation and potential. Cryptocurrency, fueled by the lowering interest rates, becomes a beacon for investors seeking growth opportunities.

The potential of cryptocurrency amidst these economic shifts is not a mere hypothesis; it’s backed by tangible indicators. The surge in market cap we witnessed, the revival of stablecoins, and the rise of NFTs and RWA tokenization — all echo the resounding potential of the crypto market. It’s a playground where innovation meets investment, and the results are not just promising but transformative.

Future Prospects: A Glimpse into Continued Growth and Innovation

What lies ahead in the crypto horizon? The crystal ball may be elusive, but the indicators suggest a future brimming with continued growth and innovation. As lower global interest rates persist, the crypto market stands as a fertile ground for both seasoned and novice investors. The potential for continued growth is not just speculation; it’s an educated anticipation based on the adaptability and resilience demonstrated by the crypto market.

In this symphony of global economic shifts and crypto resurgence, the future holds the promise of more than just financial gains. It’s a glimpse into a realm where innovation flourishes, and the boundaries of what’s possible continue to expand. As we sail into the unknown waters of tomorrow, the only certainty is that the crypto market, fueled by macroeconomic factors, is poised to ride the waves of continued growth and unfettered innovation.

Conclusion

In conclusion, the crypto market’s boom, propelled by a 110% surge in market cap, is not a mere blip on the financial radar. It’s a testament to the market’s resilience and adaptability in the face of macroeconomic shifts. As we reflect on the past and peer into the future, one thing is clear — the crypto narrative is far from over. It’s a dynamic story, a saga of innovation and growth, and the next chapters hold the promise of further surprises, challenges, and, most importantly, opportunities. Stay tuned for the unfolding saga of the crypto market, where each surge is not just a number but a marker of a revolution in progress.

5

1

Crypto Market

Crypto Market Cap

Stablecoin

Nft

Rwa Tokenization

5

1

Follow

Follow

Written by Emily George

277 Followers

·

Writer for

Coinmonks

I am an experienced Crypto writer in Blockchain & Cryptocurrency Field.

More from Emily George and Coinmonks

Emily George

Emily George

in

TokenTrends

Upcoming Meme Coin Development Wave: 5 Meme Coins Poised for Explosive Growth in 2024

In the ever-evolving world of cryptocurrency, meme coins are the rollercoasters of the market, and Shiba Inu (SHIB) has been leading the…

14 min read

·

Nov 23, 2023

53

2

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

736

5

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

41K

1095

Emily George

Emily George

in

Coinmonks

Transforming Finance: The Power of Real-World Asset Tokenization in DeFi

If you’ve been following the exciting world of DeFi, you probably expected it to be a disruptor in the realm of traditional finance…

13 min read

·

Oct 28, 2023

26

Recommended from Medium

Unicorn Ultra

Unicorn Ultra

in

Unicorn Ultra

What is BRC-20? How BRC-20 Tokens Are Revolutionizing The Bitcoin Blockchain

The cryptocurrency world has witnessed a significant development with the emergence of BRC-20 tokens, a novel token standard on the Bitcoin…

5 min read

·

Dec 21, 2023

104 The Pareto Investor

The Pareto Investor

The Beautiful Mathematics Behind Bitcoin

The One and Only Formula You Need to Know to Understand the Genius Behind Satoshi’s Masterpiece.

·

3 min read

·

6 days ago

290

3

Lists

Staff Picks559 stories

Staff Picks559 stories

·

648

saves

Stories to Help You Level-Up at Work19 stories

Stories to Help You Level-Up at Work19 stories

·

423

saves

Self-Improvement 10120 stories

Self-Improvement 10120 stories

·

1227

saves

Productivity 10120 stories

Productivity 10120 stories

·

1122

saves Bianca Buzea

Bianca Buzea

in

LUKSO

LSP7 vs ERC20: Top 6 Differences

In the ever-evolving landscape of blockchain standards, LSP7- Digital Asset has emerged as a groundbreaking innovation. For those familiar…

4 min read

·

Jan 11

48

0xAnn

0xAnn

in

Crypto 24/7

What we know about Bitcoin ETFs so far

It’s finally here, so how is the first impression?

·

5 min read

·

6 days ago

98

3

MetaBlox

MetaBlox

in

MetaBlox Network

These Top DePIN projects Will Bring Web3 Mainstream in 2024

The DePIN, or Decentralized Infrastructure Network, has become one of the hottest trends in Web3 this year while, after the collapse of…

9 min read

·

Nov 2, 2023

213

6

Shogun Saski

Discover 3 FREE tools you can use to find and buy new gems before they moon.

Forget Coinbase and Binance — real gains happen before listing. By the time you are buying on CEXs, you’re someone’s exit strategy. This…

4 min read

·

Jan 4

70

1

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)