Oh,nooo ! Again the FED ?

Just like all participants in the market, here we are again, circling around the frenzy of "What will the FED interest rate decision be, how will it be, and by how much?"

These days, economists' eyes are on the first interest rate decision of the year. I wonder if Powell has once again prepared his familiar statements and completed his preparations?

Friends, today let's take a closer look at what's being discussed in the market, and what everyone is saying as we seek answers to these questions together.

Investors continue to nervously await the Federal Reserve's (FED) interest rate decision in January. With the closely watched FED interest rate decision approaching, which will determine the first interest rate of 2024, the dollar, gold, stock, and cryptocurrency investors are keeping a close eye on it. As the first policy interest rate of the year from the FED is set to be announced, investors are starting to gravitate towards safe harbors to reduce risks.

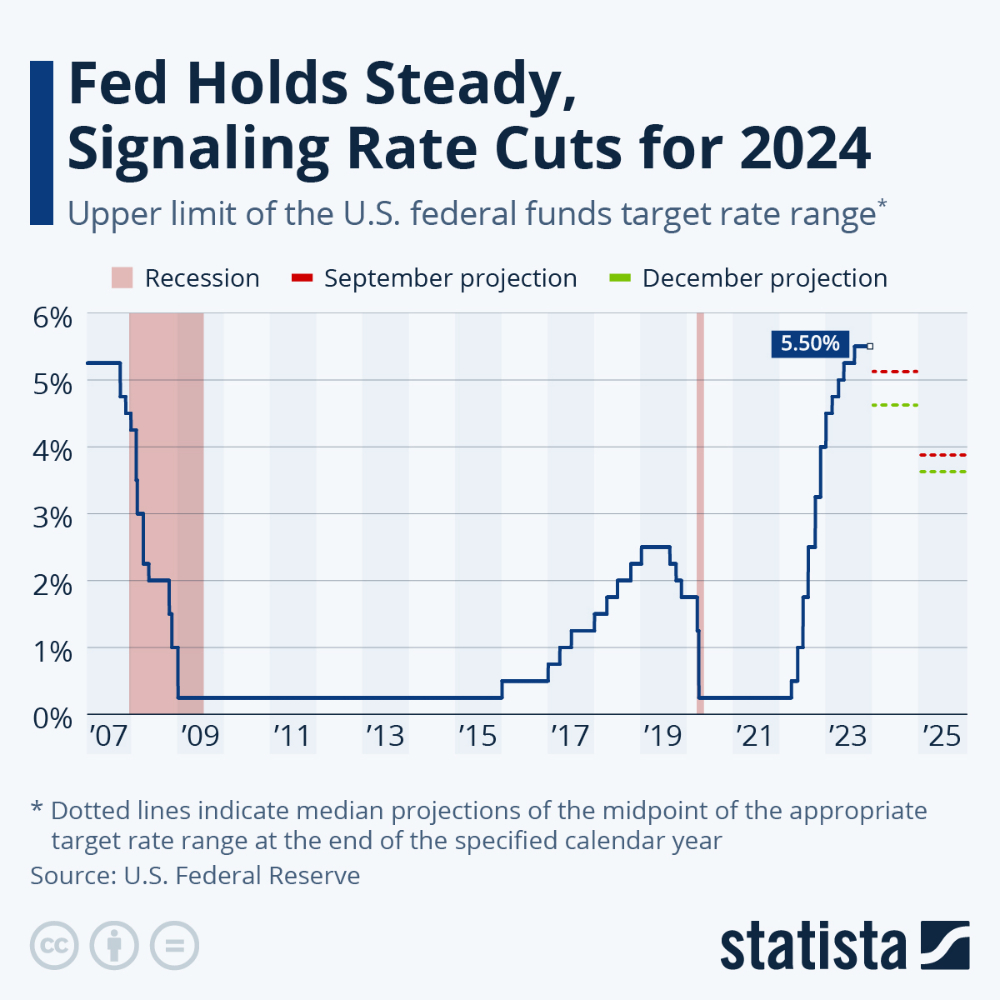

So, could the January FED interest rate decision bring a surprise? As we know, when the FED will begin interest rate cuts remains of great importance to investors.

WHEN IS THE FED INTEREST RATE DECISION ?

The Federal Reserve's (FED) January interest rate decision meeting will be held on January 31, 2024, and the critical interest rate decision will be announced.

WHAT ARE ECONOMISTS' INTEREST RATE EXPECTATIONS ?

Global markets started the week with mixed movements as the week when the Federal Reserve (Fed) will announce its monetary policy decisions began.

While expectations continue to be priced in that hawkish policies that have been ongoing globally for about 2 years will gradually give way to dovish steps, uncertainties remain about when central banks will start interest rate cuts.

After spending 1.5 years with tight monetary policies, the Fed had said that it could end interest rate hikes. As the first meeting of 2024 approaches, global markets and Bitcoin prices are seeing slight increases, but investors are still confused.

While it is certain that the Fed will keep its policy rate unchanged in the pricing in financial markets on Wednesday, it is expected that the signals to be taken from the policy text and the statements of Fed Chairman Jerome Powell will affect asset prices.

Analysts, stating that it is seen as certain that the Fed will start interest rate cuts in the May meeting, expressed that uncertainties continue to remain strong in pricing for March.

The Fed had announced in the previous period that there would be no more future interest rate hikes, and the markets had relaxed.

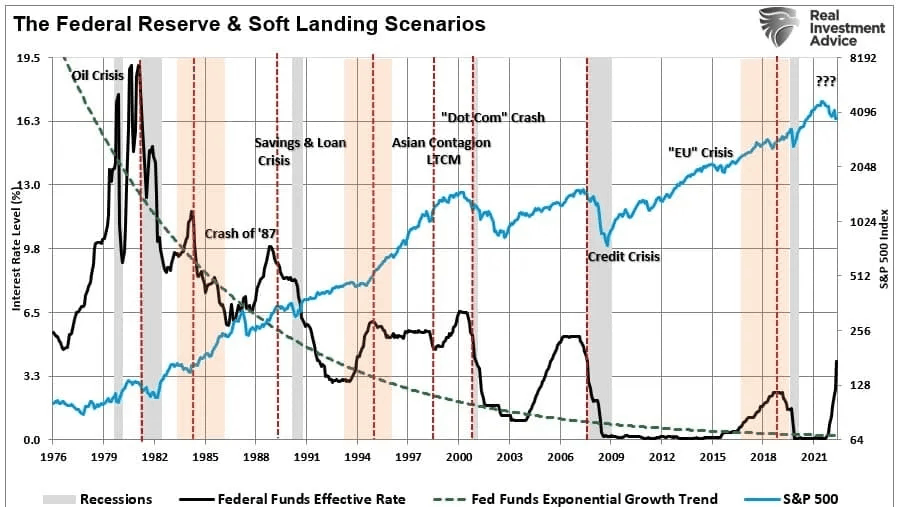

IS " SOFT LANDING SCENARIO" POSSIBILE ?

Market expectations for the first meeting of the year on January 31, 2024, indicate a 98% chance of no new interest rate hikes. Interest rate cuts are expected to start as early as March and no later than May, depending on future data.

According to the data announced last week in the USA, analysts pointed out that economic activity remained strong but the slowdown in inflationary pressures was noteworthy, stating that this situation increased the possibility of a "soft landing" in the country's economy.

Analysts stated that the uncertainties about the steps the Fed will take in the future led to a search for direction in asset prices; however, with the expectation that strong economic activity will continue to positively affect companies' profitability, record closings in stock markets continue to come.

In light of all these developments, the price of Bitcoin is trading above $42,000 before the Fed meeting. Similarly, gold is trying to surpass the $2,030 level on the opening day of the week. Although U.S. indices and stock futures markets experience limited increases, they have attracted attention by breaking price records in recent times.

Let's see if J. Powell will pull a rabbit out of his hat this Wednesday evening, or he'll just add another familiar phrase to the expectations of market analysts and investors. We'll wait and see.

Sources :

- https://en.wikipedia.org/wiki/Federal_funds_rate

- https://www.forbes.com/advisor/investing/fed-funds-rate-history/

- https://www.statista.com/chart/21023/us-federal-funds-target-rate/

- https://www.chicagofed.org/research/data/beige-book/current-data

- https://bnnbreaking.com/world/us/walking-the-tightrope-can-the-u-s-economy-achieve-a-soft-landing-in-2024/

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)