Conquering Inflation

The financial landscape can be a tumultuous ocean, and in recent times, the waves of inflation have risen high, threatening to capsize even the most well-managed portfolios. But fear not, savvy investors! Just like seasoned sailors can navigate through storms, there are strategies you can employ to conquer inflation and keep your financial ship afloat. So, grab your metaphorical sextant and set your course for calmer waters, as we explore the various ways to protect your wealth against the inflationary tide.

Understanding the Enemy: Demystifying Inflation

Inflation Before we can battle inflation, we must understand its nature. Simply put, inflation is the sustained rise in the price of goods and services over time. This means your hard-earned dollars buy less each year, eroding the purchasing power of your savings and investments. While some inflation is considered healthy for a thriving economy, when it surges too high, it can wreak havoc on personal finances.

Before we can battle inflation, we must understand its nature. Simply put, inflation is the sustained rise in the price of goods and services over time. This means your hard-earned dollars buy less each year, eroding the purchasing power of your savings and investments. While some inflation is considered healthy for a thriving economy, when it surges too high, it can wreak havoc on personal finances.

Identifying the Threats: Inflation's Impact on Your Portfolio

How Does Inflation Affect Your Portfolio

The impact of inflation varies across different asset classes. Certain investments, like bonds with fixed interest rates, become less attractive as their returns fail to keep pace with rising prices. Stocks, while offering the potential for growth, can also be susceptible to inflation-driven market volatility. This is why, in an inflationary environment, it's crucial to diversify your portfolio and adjust your strategies accordingly.

Charting Your Course: Strategies for Inflationary Times

Strats

Seek Inflation-Resistant Assets:

Consider investments that tend to perform well when inflation rises, such as commodities like gold or oil, real estate, and inflation-protected securities (TIPS). These assets can help maintain the purchasing power of your portfolio.

Embrace Diversification:

Don't put all your eggs in one basket. Spread your investments across different asset classes, industries, and geographic regions to minimize risk and ensure some areas of your portfolio benefit from inflationary trends.

Diversification

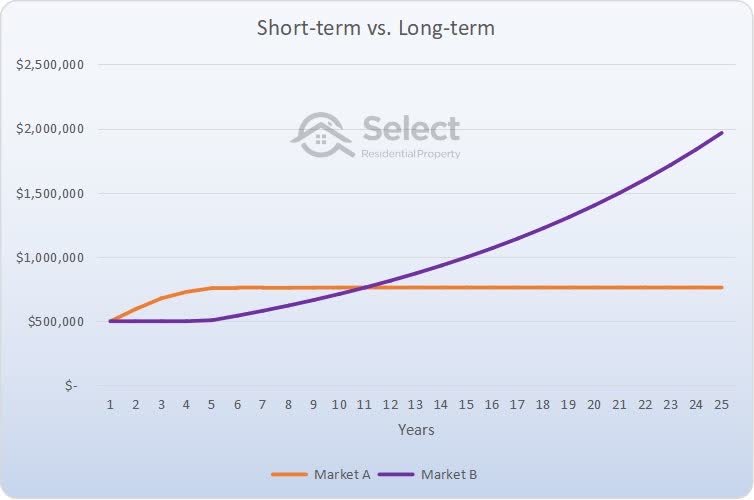

Focus on Long-Term Growth:

While inflation might cause short-term bumps, don't lose sight of your long-term financial goals. Investing in assets with strong growth potential, like stocks in innovative companies, can help outpace inflation over time.

Review and Rebalance:

Regularly review your portfolio and adjust your allocation as needed. As inflation changes, the optimal mix of assets will shift, and maintaining a diversified portfolio requires constant vigilance.

Seek Professional Guidance:

If navigating the complexities of inflation-proofing your portfolio feels overwhelming, don't hesitate to seek professional help. A financial advisor can provide personalized recommendations and strategies tailored to your specific circumstances and risk tolerance.

Remember:

Conquering inflation is a marathon, not a sprint. Be patient, adjust your strategies as needed, and stay calm amidst the market turbulence.

Focus on building a well-diversified portfolio that can withstand economic fluctuations.

Seek knowledge and expertise to equip yourself with the tools for informed investment decisions.

By charting your course with careful planning and strategic adaptations, you can weather the inflationary storm and keep your financial ship sailing towards safe harbor. So, embrace the challenge, adjust your sails, and conquer inflation. Your financial future depends on it!

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)