Navigating Cryptocurrency Tax Implications: Insights for Investors in the US, UK, and Canada

The surge in popularity of cryptocurrency investments has introduced both promising prospects and complexities for investors. 🚀 As the digital asset market progresses, regulatory frameworks governing these assets continue to evolve. A pivotal concern for cryptocurrency investors is the intricate landscape of taxation surrounding their holdings. 💸 In the United States, the United Kingdom, and Canada, the treatment of cryptocurrencies for tax purposes is multifaceted and continually changing. The implications of these tax regulations hold the potential to substantially influence the financial outcomes of investors, emphasizing the need for a thorough understanding and proactive approach in navigating this dynamic terrain.

The surge in popularity of cryptocurrency investments has introduced both promising prospects and complexities for investors. 🚀 As the digital asset market progresses, regulatory frameworks governing these assets continue to evolve. A pivotal concern for cryptocurrency investors is the intricate landscape of taxation surrounding their holdings. 💸 In the United States, the United Kingdom, and Canada, the treatment of cryptocurrencies for tax purposes is multifaceted and continually changing. The implications of these tax regulations hold the potential to substantially influence the financial outcomes of investors, emphasizing the need for a thorough understanding and proactive approach in navigating this dynamic terrain.

Bybit offer: Deposit $50, and GET 10 USDT (withdrawable)!

Understanding Cryptocurrency Taxation in the United States:

In the United States, the Internal Revenue Service (IRS) has undergone a nuanced evolution in its approach to taxing cryptocurrencies. The IRS categorizes cryptocurrencies as property rather than traditional currency, subjecting transactions involving digital assets to capital gains tax. Investors bear the responsibility of reporting detailed information on their cryptocurrency transactions in tax returns. This includes specifics such as acquisition cost, sale proceeds, and holding periods.

Also read: The 7 Known Crypto Companies Based In The Tax-Havens

Investors must remain cognizant of potential tax liabilities stemming from various activities, including trading, mining, and receiving cryptocurrency as income. Accurate reporting is paramount, as failure to do so may lead to penalties and interest. To facilitate compliance, the IRS offers guidelines and tools, underscoring its commitment to transparency in the ever-expanding cryptocurrency landscape. 📑💼💰

Navigating Cryptocurrency Taxation in the United Kingdom:

The United Kingdom has proactively adjusted its tax regulations to align with the increasing prominence of cryptocurrencies. Her Majesty’s Revenue and Customs (HMRC) follows a taxation approach akin to the United States’ Internal Revenue Service (IRS), treating cryptocurrency transactions as subject to capital gains tax.

Cryptocurrency investors in the UK are obligated to maintain meticulous transaction records, which must be diligently reported on their annual tax returns. Specific tax rules extend to businesses that accept cryptocurrencies as payment. Notably, individuals utilizing cryptocurrencies for day-to-day transactions may find relief, as holdings for personal use could be exempt from capital gains tax. This nuanced approach reflects the UK’s commitment to adapting tax regulations to accommodate the evolving landscape of digital assets. 📊🏴💷

Canada’s Approach to Cryptocurrency Taxation:

Canada mirrors the taxation methodology of the United States and the United Kingdom, treating cryptocurrencies as commodities subject to capital gains tax. The Canada Revenue Agency (CRA) mandates that investors diligently report cryptocurrency transactions on their income tax returns. Accurate record-keeping is paramount, as the omission of transactions may result in penalties.

Canadian investors must grasp the tax ramifications associated with diverse cryptocurrency activities, including mining, staking, and participating in initial coin offerings (ICOs). The CRA offers guidelines, facilitating taxpayers in navigating the intricate terrain of cryptocurrency taxation. This aligns with the CRA’s objective to promote compliance and transparency within the evolving realm of digital assets. 🇨🇦💰📈

Global Collaboration on Crypto Taxation:

Cryptocurrencies, operating globally, pose challenges for investors grappling with diverse tax regulations. In response, tax authorities worldwide are collaborating to establish international standards for cryptocurrency taxation. Initiatives like the Common Reporting Standard (CRS) prioritize enhancing transparency and simplifying the reporting of financial information, encompassing cryptocurrency holdings. This collaborative approach reflects a concerted effort to create a cohesive framework that accommodates the borderless nature of digital assets, fostering a more transparent and standardized global environment for cryptocurrency taxation. 🌐💼🌍

Embracing Technology for Tax Compliance:

In the contemporary intersection of technology and finance, utilizing technological solutions for tax compliance becomes imperative. The advent of cryptocurrency tax software and platforms has streamlined the complex process of tracking transactions, calculating gains and losses, and generating accurate tax reports. These tools not only boost efficiency but also play a crucial role in ensuring compliance with the continuously evolving landscape of tax regulations. As financial technology advances, the integration of these solutions not only facilitates smoother operations for investors but also contributes to a more transparent and accountable financial ecosystem. 💻📊🌐

Educational Initiatives for Investors:

Acknowledging the intricacies of cryptocurrency taxation, educational initiatives assume a pivotal role in empowering investors to navigate this complex landscape. Collaborative efforts among governments, financial institutions, and industry organizations are essential to provide accessible and comprehensive resources, aiding investors in understanding their tax obligations. Webinars, workshops, and online resources become valuable tools in fostering greater awareness and compliance within the cryptocurrency community. By promoting education and knowledge-sharing, stakeholders contribute to a more informed and responsible approach to cryptocurrency taxation, aligning with the broader goal of building a well-informed and compliant digital financial ecosystem. 📚💡🌐

Embracing a Proactive Approach:

Encouraging a proactive stance toward tax compliance is paramount for cryptocurrency investors. Staying well-informed about regulatory updates, maintaining meticulous transaction records, and seeking professional advice are instrumental in mitigating potential tax liabilities. Embracing compliance not only ensures adherence to the law but also contributes significantly to the broader acceptance and legitimacy of cryptocurrencies in the financial landscape. By demonstrating a commitment to responsible financial practices, investors play a crucial role in shaping a positive perception of cryptocurrencies, fostering trust among regulators, stakeholders, and the wider public. 📊💼📝

Conclusion

The surge in cryptocurrency investments brings both promise and complexity, with evolving tax regulations in the US, UK, and Canada. A global collaborative effort aims to establish standardized crypto taxation through initiatives like the Common Reporting Standard. Embracing technology and educational initiatives enhances compliance. Encouraging a proactive approach further solidifies cryptocurrency’s acceptance. Ultimately, informed investors, supported by evolving regulatory frameworks, contribute to the legitimacy and trustworthiness of cryptocurrencies in the dynamic financial landscape.

Disclaimer: The author’s thoughts and comments are solely for educational reasons and informative purposes only. They do not represent financial, investment, or other advice.

Cryptocurrency

Cryptos

Blog

Cryptotax Follow

Follow

Written by Coinscapture

1.7K Followers

Coinscapture is the best, real-time, high-quality cryptocurrency market data provider, by listing 2000+ cryptocurrency globally. https://coinscapture.com/

More from Coinscapture

Coinscapture

Coinscapture

in

CoinsCapture

10 Known Decentralized Email Service Providers

The nature of blockchain technology has brought an evolution in the space of innovation and technology. One of the key features of…

4 min read

·

Aug 31, 2020

84

1

Coinscapture

Coinscapture

Top 10 Telegram Channels for Crypto Signals in 2023

5 min read

·

Sep 21, 2023

10

Coinscapture

Coinscapture

in

CoinsCapture

5 Most Popular Web3 Books To Read

Internet development will progress to Web3 in the future. This new platform will revolutionize our online interactions because of its…

5 min read

·

Sep 13, 2022

8

Coinscapture

Coinscapture

Strategies for Hash Rate Enhancement in Cryptocurrency Mining

Cryptocurrency mining, a fundamental process in blockchain technology, involves validating and securing transactions on a network. Miners…

4 min read

·

Oct 2, 2023

3

Recommended from Medium

The Pareto Investor

The Pareto Investor

The Beautiful Mathematics Behind Bitcoin

The One and Only Formula You Need to Know to Understand the Genius Behind Satoshi’s Masterpiece.

·

3 min read

·

6 days ago

291

3 Geoffrey Robichaux

Geoffrey Robichaux

Behind the Story: Navigating the Art of Prompt Engineering in Generative AI

There is more to a story than the final destination. The journey along the way captures all the small lessons, tangents, and bumps in the…

8 min read

·

4 days ago

389

Lists

Modern Marketing54 stories

·

376

saves

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

631

saves

Staff Picks559 stories

Staff Picks559 stories

·

649

saves 0xAnn

0xAnn

in

Crypto 24/7

Making Money Scalping Crypto

“Why do you work 9–5 when crypto trading is basically free money?”

·

7 min read

·

Jan 10

580

11

SlowMist

SlowMist

Comprehensive Report on North Korean Hackers, Phishing Groups, and Money Laundering in 2023

The preceding article offered an in-depth analysis of the blockchain security landscape in 2023. This article shifts the focus to the…

9 min read

·

Jan 11

20

Unicorn Ultra

Unicorn Ultra

in

Unicorn Ultra

What is BRC-20? How BRC-20 Tokens Are Revolutionizing The Bitcoin Blockchain

The cryptocurrency world has witnessed a significant development with the emergence of BRC-20 tokens, a novel token standard on the Bitcoin…

5 min read

·

Dec 21, 2023

105

Maximilian Schima

Maximilian Schima

in

Financial Reflections

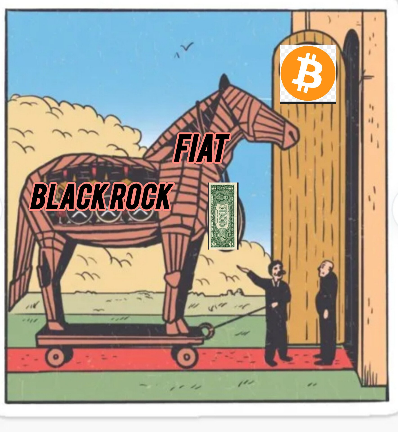

Bitcoin ETF — a Trojan Horse

Why cash-only ETFs contradict the basic idea of Bitcoin

6 min read

·

4 days ago

56

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)