Stablecoin Supply Increases by $5 Billion Since the US Election

Since the US election, money has been pouring into the crypto market, clearly shown by the significant increase in stablecoin supply.

In the past week alone, the stablecoin supply has expanded by $5 billion, marking many investors pouring capital into the crypto market. Notably, the amount of stablecoins on exchanges also hit a record for the year, up to $41 billion. It is highly likely that this is a reserve fund ready to buy digital assets when the opportunity comes.

In other words, the increase in stablecoin balances on exchanges is a signal that investors are hoarding capital, waiting for the right time to enter the crypto market.

The top two are still the familiar stablecoins USDT of Tether and USDC of Circle. Specifically, the amount of USDT in circulation increased by $3.8 billion, reaching a new record of $125 billion, consolidating the previous increase. Meanwhile, USDC supply increased by $1.6 billion to nearly $37 billion.

The “swelling” stablecoin supply also reflects the influx of capital into the crypto ecosystem. Stablecoins, whose value is often pegged to the USD, serve as an important source of liquidity in crypto trading and are considered “cash reserves” to buy assets on exchanges.

USDT is the most liquid trading pair on international exchanges, while USDC is mainly used on Coinbase (focused on the US market) and DeFi applications.

According to David Shuttleworth, partner at Anagram, before the election, both individual and institutional investors were mainly in a wait-and-see mode. After the results were out, liquidity and buying pressure began to increase sharply.

The growth of stablecoins occurred in parallel with vibrant activities in many areas of the digital asset economy. Bitcoin (BTC) prices have been on a tear following Donald Trump’s victory and expectations of a crypto-friendly administration that have fueled market sentiment to “extreme greed.”

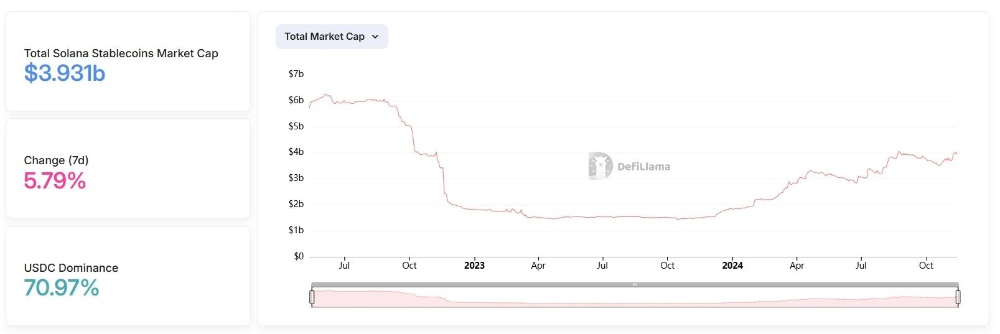

The USDC supply on the Solana (SOL) network has increased by 14% over the past week, reaching nearly $3.9 billion, according to data from DeFiLlama. The growth comes as DeFi protocols on Solana have seen a resurgence in transaction volume and network revenue.

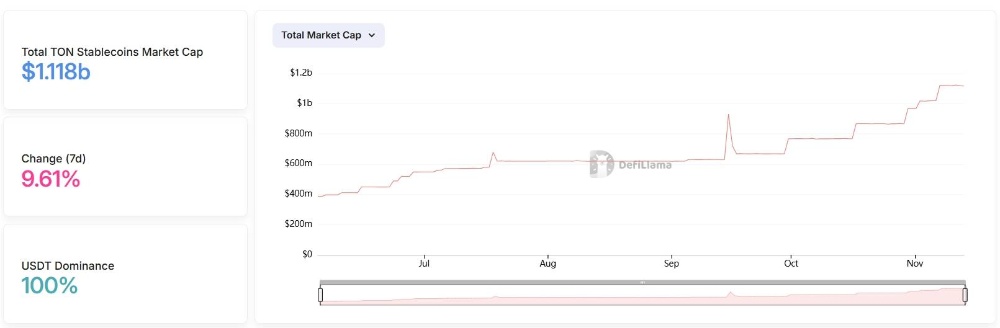

Meanwhile, the USDT supply on TON has also hit a new record of $1.1 billion, up 10% over the same period, as users continue to increase their engagement with the ecosystem surrounding the popular messaging app Telegram.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)