Bitcoin spot ETF hits $3.1 billion in trading volume on second day - BTC price continues to fall

Spot Bitcoin ETFs continue to see impressive trading activity, albeit down a bit from day one.

Bitcoin spot ETF hits $3.1 billion in trading volume on second day - BTC price continues to fall

Bitcoin spot ETF hits $3.1 billion in trading volume on second day - BTC price continues to fall

According to statistics from The Block, transaction date ETF Bitcoin spotMonday (January 12 - US time) saw 3.1 billion USD in value changed hands on US stock exchanges. Although this volume level is lower figure 4.6 billion USDof January 11, but it still shows huge demand for these products, with the total trading volume of the first two days being a whopping 7.7 billion USD.

Leading the way on the second day of trading is continued to be GBTC'sGrayscalewith a volume of up to 1.8 billion USD, followed by IBIT ofBlackRockand Fidelity's FBTC at trading volumes of $563 million and $431 million, respectively.

Statistics on Bitcoin spot ETF trading volume in the first two days. Source: The Block (January 13, 2024)

Statistics on Bitcoin spot ETF trading volume in the first two days. Source: The Block (January 13, 2024)

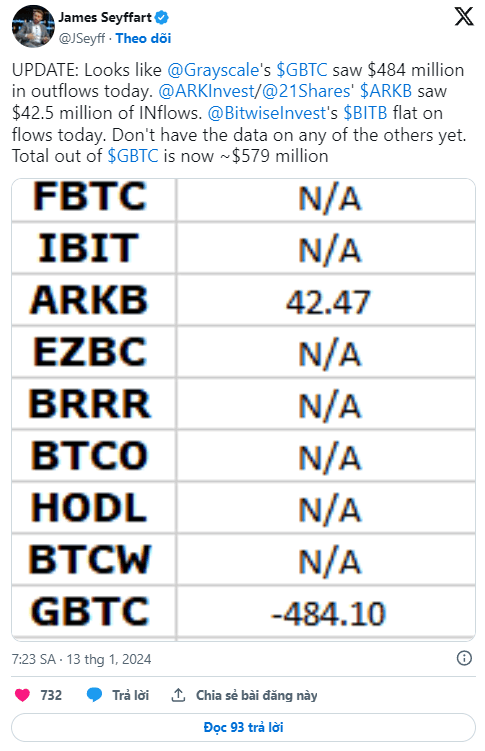

However, as reported by Coin68, the majority of GBTC trading volume on January 11 was sold or converted to other products, shown through data.divestment flow is up to 95 million USD. It is also the only ETF with a negative cash flow recorded on the first day of Bitcoin ETF trading. Some analysts say the same thing is happening again on January 12. Although there are no exact figures yet, preliminary statistics show that the money flowing out of GBTC on the second trading day could reach nearly half a billion USD.

Bitcoin price in the last 12 hours has dropped more than 8% from 45,900 USD to 41,500 USD, when profit-taking sentiment after the approval of the Bitcoin spot ETF dominated the market. Also, news showsGrayscale transferred 4,000 BTC to CoinbaseTo serve the purpose of converting GBTC shares back to physical BTC, it also started the dump on the evening of January 12.

1h chart of the BTC/USDT pair on Binance at 09:35 AM on January 13, 2024

1h chart of the BTC/USDT pair on Binance at 09:35 AM on January 13, 2024

In the last 12 hours, nearly 280 million USD in derivative orders were burned with a long ratio of 85.6%. BTC accounts for nearly half of the liquidation value at $112 million, followed by ETH at $62 million and the rest are other altcoins.

Liquidation data in the last 12 hours, screenshot of CoinGlass at 09:40 AM on January 13, 2024

Liquidation data in the last 12 hours, screenshot of CoinGlass at 09:40 AM on January 13, 2024

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)