SOL, AVAX Lead Crypto-Market Recovery, Bitcoin Tops 50-Day Average Before Fed Meeting

Altcoins' consistent positive performance over the past six days is boosting optimism and setting up bitcoin to test $46,000, one analyst said.:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4FGBXAOD2NCIRMCS6L2FEFMSUE)

- Altcoins are outperforming bitcoin and ether, a sign investor interest is broadening beyond the largest cryptocurrencies.

- The Fed is likely to keep rates unchanged on Wednesday. Potential dovish hints could bode well for bitcoin, one observer said.

The total crypto market capitalization has bounced to $1.74 trillion from $1.61 trillion in a week, with alternative cryptocurrencies (altcoins) like (SOL), (AVAX), and (ICP) spearheading the recovery.

According to Velo Data, Solana's SOL has risen 27% to $103, nearly reversing losses seen following the Jan. 11 debut of spot-based bitcoin exchange-traded funds (ETFs) in the U.S. The rally comes amid surging user interest in Solana-based trading aggregator Jupiter, where volumes topped the $500 million mark on Monday, surpassing the activity on industry-leading decentralized exchange Uniswap.

AVAX, the native token of Ethereum rival Avalanche, has rallied over 25% in one week, while tokens such as ICP, NEAR, DOT, and XMR have added between 13% and 22%.

Bitcoin (BTC), the largest cryptocurrency by market value, has gained nearly 10% to trade above the widely tracked 50-day simple moving average at $42,870. Crossovers above and below that level are said to signal the strengthening of bullish or bearish momentum.

Ethereum's native token, ether (ETH), the second-largest coin, has risen just 0.6%. The underperformance likely stems from market makers trading against the direction of the price move, thereby arresting the upside price volatility.

"Altcoins' consistent positive performance over the past six days is setting up optimism, setting up bitcoin for a test of $46,000," Alex Kuptsikevich, a senior market analyst at FxPro, said in an email. "The outperformance in major altcoins points to a broadening of participant interest beyond the two largest coins."

Kuptsikevich said bitcoin's move above the 50-day average is important, but not yet solid evidence of a bullish trend, and the outperformance of altcoins may be short-lived.

"Don't expect sustained demand for smaller altcoins or meme coins this year – it usually happens after a prolonged bull market," Kuptsikevich noted.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HFNIJJUU6FHFXBECTRRNCSM2HQ.png) Performance of cryptocurrencies since Jan. 23. (Velo Data)

Performance of cryptocurrencies since Jan. 23. (Velo Data)

Focus on Fed

The U.S. Federal Reserve will announce its rate decision on Wednesday at 19:00 UTC. Half an hour later, Chairman Jerome Powell will speak at a press conference, explaining the decision and policy path.

The central bank is likely to keep the benchmark borrowing cost between 5.25% and 5.5%, with markets now anticipating a first rate cut in May instead of the previously expected March.

The focus will be on how fast policymakers intend to unwind the 11-rate-hike streak or the so-called policy tightening that began in March 2022 and peaked in June 2022.

"The market is sensitive to the Fed's tone, with a dovish [policy easing] shift potentially boosting risk appetite and directing more capital into Bitcoin and related ETFs," Tagus Capital said in its daily newsletter on Tuesday.

STORY CONTINUES BELOW

Recommended for you:

- MIM Stablecoin Suffers Flash Crash Amid $6.5M Exploit

- Bitpanda Crypto Exchange to Withdraw From Netherlands

- Fintech Provider Portal Raises $34M Seed Round for Bitcoin-Based Decentralized Exchange

Read: U.S. Debt Announcement May Be Pivotal for Crypto Traders

Edited by Sheldon Reback.

Newsletter

Every Wednesday

CryptoLong&Short

Sign up for Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor.

Enter your Email

Sign Up

By clicking ‘Sign Up’, you agree to receive newsletter from CoinDesk as well as other partner offers and accept our terms of services and privacy policy.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. In November 2023, CoinDesk was acquired by Bullish group, owner of Bullish, a regulated, institutional digital assets exchange. Bullish group is majority owned by Block.one; both groups have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief of The Wall Street Journal, is being formed to support journalistic integrity.

This Solana DEX Reached $520 Million in Daily Trading Volume

In Brief

- Solana's Jupiter decentralized exchange has surged past Ethereum's Uniswap V3.

- It has enjoyed a remarkable $520 million and the DEX is set to debut a native token.

- Solana's ecosystem is gaining prominence, fueled by airdrops and new partnerships.

- PROMO

- Explore AI-powered automative trading strategies for Bitcoin, Solana and Doge with up to 80% success rate.Try AlgosOne now

On January 27, the Jupiter decentralized exchange (DEX) built on the Solana blockchain outpaced Ethereum’s Uniswap V3 in daily trading volume.

On January 27, the Jupiter decentralized exchange (DEX) built on the Solana blockchain outpaced Ethereum’s Uniswap V3 in daily trading volume.

It is a liquidity aggregator in the Solana ecosystem. Although the platform was introduced in 2021, it has processed $66.64 billion of transactions.

Jupiter DEX Soaring Trading Volume

SolanaFloor, a Step Finance-powered platform, reported a remarkable 24-hour trading volume of nearly $520 million for Jupiter on January 27. This surge helped it surpass Uniswap v3’s Ethereum market, which recorded $510 million at the time.

Jupiter has been on an upward trajectory. Indeed, the aggregator’s trading volume peaked at $16 billion in December. It is poised to surpass that figure this month, having already clocked over $15 billion.

Crypto community members attribute this milestone to Solana’s low fees. Anatoly Yakovenko, Solana’s co-founder, expressed his astonishment with a mind-blown emoji, while Adeniyi Abiodun, co-founder of the rival Sui blockchain network, acknowledged the achievement.

Meanwhile, CoinMarketCap positions Jupiter as the fifth-largest DEX by trading volume in the past day. Its volume trails behind Uniswap v3, Polygon-based Kine Protocol, Cosmos-based dYdX chain, and Helix. Interestingly, Jupiter is poised to launch its native JUP token by the month’s end, as confirmed by the project’s pseudonymous developer, Meow.

“Remember, Jupuary is not about launching a token. There are thousands of that everyday. This Jupuary is about creating symbolism, community roots, and crucial new products together. So this Jupuary, let us launch the symbol for DeFi 2.0 together, kickstart the most elite force to push the meta forward, and wtf, experiment on building a new groundbreaking launchpad,” Meow said.

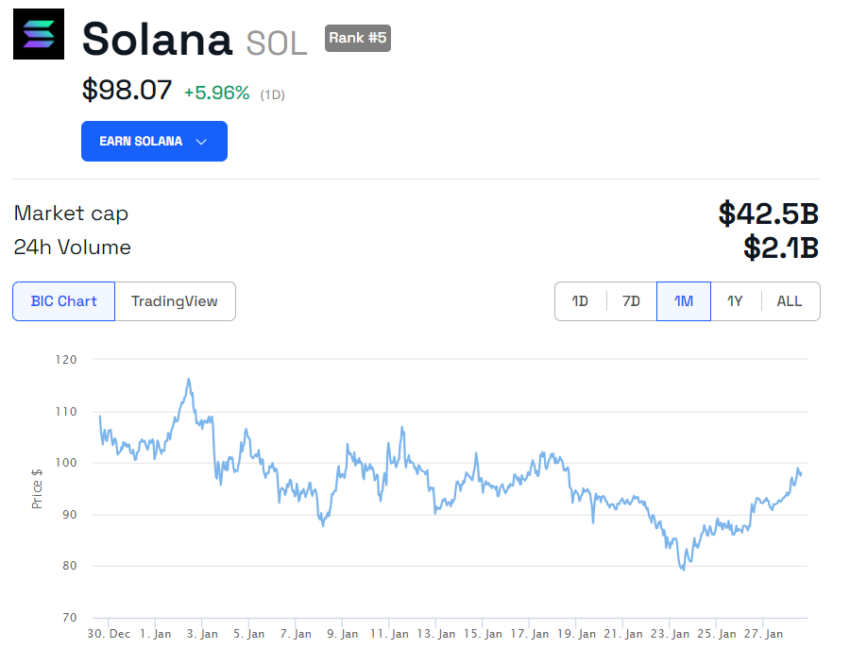

Solana (SOL) Price Approaches $100

Solana has experienced a robust resurgence in the past 24 hours, following a week of predominantly hovering around the $80 mark.

Indeed, SOL’s value surged over 5% to approximately $100 before retracing to $98. This upswing has propelled its market capitalization to $42.5 billion.

Read more: How to Buy Solana (SOL) and Everything You Need To Know Solana Price Performance. Source: BeInCrypto

Solana Price Performance. Source: BeInCrypto

Analysts foresee the potential continuation of this upward trend, drawing parallels to Solana’s remarkable 660% surge last year.

“A nice breakout of Solana. It is painting such a solid structure,” crypto analyst Ted wrote.

Intriguingly, Solana’s ecosystem is garnering attention within the crypto community due to the abundance of airdrops designed to attract new members and its many partnerships. This strategy has contributed to the Solana network’s heightened engagement and interest.

DISCLAIMER

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)